You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Hi/Lo of the day trading method.

- Thread starter joffie

- Start date

joffie

TFG Forum Junkie

Okay guys I have come up with a more simpler method for trading this high/low of the day using support and resistance levels, I think anyone struggling to get the grasp of this method will find this much easier.

First thing we do is look at current closed Daily candle, lets say it closed bullish. Here we will still be looking to trade the high or low of the day during the London or US session, but using daily support and resistance to confirm this high/low of the day.

First thing we do is mark the high of the bullish candle, this will be the reversal point of resistance we are looking to sell at if price gets to this high. Then from the high of this bullish candle we will mark the next support level being a low of a previous daily candle, watching price if its making a new low of the day, marking the next support if each support is broken lower until we have a low of the day off a support with a bullish candle on the 1hr chart. This here we are looking for this to be a continuation day with a daily retrace type of entry but catching it on a 1hr chart low of the day, and looking to buy up to the previous days high where we would watch for any sell signals or looking for price to break making new highs holding the buy trade. Vice Versa if bearish daily candle.

I will show a smaple of each trade type for better understanding...

First thing we do is look at current closed Daily candle, lets say it closed bullish. Here we will still be looking to trade the high or low of the day during the London or US session, but using daily support and resistance to confirm this high/low of the day.

First thing we do is mark the high of the bullish candle, this will be the reversal point of resistance we are looking to sell at if price gets to this high. Then from the high of this bullish candle we will mark the next support level being a low of a previous daily candle, watching price if its making a new low of the day, marking the next support if each support is broken lower until we have a low of the day off a support with a bullish candle on the 1hr chart. This here we are looking for this to be a continuation day with a daily retrace type of entry but catching it on a 1hr chart low of the day, and looking to buy up to the previous days high where we would watch for any sell signals or looking for price to break making new highs holding the buy trade. Vice Versa if bearish daily candle.

I will show a smaple of each trade type for better understanding...

joffie

TFG Forum Junkie

joffie

TFG Forum Junkie

Here is a sell of the high of the day first then a buy of a retrace entry on the GU and a failed buy of the previous days low with a hedged sell still ending up the day with a profit on the EU

Attachments

tjenarvi

TFG Forum Junkie

not a bad idea here, higher time frame trading confluence with smaller time frameHere are 2 trades past week with EU and GU sold of previous days high resistance and with it also being a valid high of the day with a close bearish.

Hi Guys,

I've finally had a little time to post this method, sorry about the delay. First off let me say this is not my method and I have learnt this from another trader. I am going to show you the basics of how to trade this method and what to look for with both EU and GU charts from last weeks trading. Now this is a day trading method and requires your attention from 8am London open until end of the day New York close if you are holding trades this late into the day. Some trades will be left over night but mainly are closed out the same day. We only trade these 2 pairs as they are the most active during these hours.

This method will required for you to hedge your position on some trades, this means we have tried to sell or buy at the low or high of the day and have got it wrong and price reverses against our entry. Here we are looking to recover our loss at best and get some profit along the way. In most cases you win more on your hedge position than your losing trade. But with every thing forex there is a risk of having both trades stopped out, which has happend a couple of times to me.

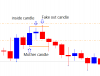

So we mark the high and low of the asian session range and look for price to make a new high or low of the day with a opposite candle. We are then looking for price to make a new high or low in the opposite direction for a profit, but on some occasions this will need to be hedged if we dont have the high/low of the day.

Once in a trade on the first reversal candle if in profit we move our stop to break even to protect the account. Then let the profit run and lock in more as price moves. I will leave this up to you how you manage your take profit targets, either a fixed or let it run. I personally will lock in a 1:2 as soon as a 1:3 has been hit and let the trade run.

Below are trades from last week using this method, any questions just let me know.

joffie

Added rule that I use is not to trade into or touching a round number, the best trades come when traded with room or bouncing off or near a round number . If I now trade near a round number I will move to break even once hit or breached rather then waiting for a reversal candle if in profit of course, other wise i look to hedge.

Trading Rules

1. Need a new high or low of the day during london and US sessions

2. Then look for a reversal candle of this high or low of the day

3. Need to see price near, bouncing off, spiked or a fake break of a round number

4. EU only traded after the 1st hour of euro session

5. GU only traded after the 1st hour of london session

6. Entry must trigger on next candle or trade is to be canceled

7. Require space for trade.. in other words room to the next round number

8. Break even on first reversal candle and let trade run

9. If a reversal after entry, hedge the trade in oposite direction, locking in a 1:1 once closed past

10. Lock in a 1:2 profit once a 1:3 has been hit and let trade run locking in profit

11.Lock in profit once a 2nd reversal candle, but giving trade still room to move

So you are use 60 minute man strategy .

jason piazza

Casual Member

Yeah I am pretty sure that is why in the second sentence he states it is not his method, giving credit to someone else and sharing tips with others in this forum. It is actually very helpful, and individuals like myself are very grateful for it.

Thanks again Joffie.

Thanks again Joffie.

joffie

TFG Forum Junkie

So you are use 60 minute man strategy .

As I have said all along I was taught this method from another forum, one of the three traders on the forum who all trade in different methods of price action trading strategies, and I found I picked it up quickly, but adding parts to suit my own trading minset. I had never heard of the 60 miniute man strategy until you posted it here, I dont know why you are so keen to keep telling me this, I learn't from a trader called Darren who I feel to be a great mentor, and if anyone wants to learn this way of trading I sugest you google it.

HiAs I have said all along I was taught this method from another forum, one of the three traders on the forum who all trade in different methods of price action trading strategies, and I found I picked it up quickly, but adding parts to suit my own trading minset. I had never heard of the 60 miniute man strategy until you posted it here, I dont know why you are so keen to keep telling me this, I learn't from a trader called Darren who I feel to be a great mentor, and if anyone wants to learn this way of trading I sugest you google it.

Here 60 minuteman

http://www.forexfactory.com/showthread.php?p=8540806#post8540806

Stefan Heinrich

Forum Newbie

The idea is good and have been around for years. Nice to see joffie has worked it out in an actual fashion and share it with us.

marvelpips

Forum Newbie

Honestly I don't know what fxvictory wants to achieve by his insulting comment. Joffie categorically stated from the onset that this method did not originate from him. We believe him and have benefited immensely from this method and other contributions from him in the past. People like fxvictory will discourage genuine traders who are out to help others in this forum. fxvictory or what are you called please stop it.So you are use 60 minute man strategy .

I did not say I have not. I just tried to tell. This strategy is that if you know to bake the trader, this strategy has started. very goodHonestly I don't know what fxvictory wants to achieve by his insulting comment. Joffie categorically stated from the onset that this method did not originate from him. We believe him and have benefited immensely from this method and other contributions from him in the past. People like fxvictory will discourage genuine traders who are out to help others in this forum. fxvictory or what are you called please stop it.

joffie

TFG Forum Junkie

hi guys, been a while since I've been here in the forum. But keep an eye on this thread because it's coming back with a new exciting twist trading the high/low of the day and high/low of the week, which works even better than before!

The main big difference, were not limited to just the gbpusd and eurusd pairs anymore, or are we going to be bothered by the Asian range indicator! Trades like these are what we can expect too

Joffie

The main big difference, were not limited to just the gbpusd and eurusd pairs anymore, or are we going to be bothered by the Asian range indicator! Trades like these are what we can expect too

Joffie

Last edited:

joffie

TFG Forum Junkie

Over the coming weeks I will be trading the high/low method once again but on the 4hr charts. So instead of the high/low of the day this will be the high/low of the week. Plus I am only taking a trade if a price pattern occurs which does not happen very often and perhaps some weeks we won't have one to take. But when they do appear they are very profitable. So patience is the key here!! If you find patience hard with trading then your in the wrong game my friend. I will later post charts of how this is traded and the pattern it self we are looking to trade. This week alone there have been 4 pairs that could have been traded and all positive for the week with one pair very profitable dropping all week. So this week alone could have made up a months trading.

Joffie

Joffie