erebus

TFG Forum Legend

Dale / others,

Has anyone heard of this concept?

Look at previous Month candle e.g. Up or Down

Look at previous Week candle e.g. Up or Down

IF Month candle was DOWN and Week candle was DOWN

Don't trade Mondays, but if that candle is UP, then trade the breakout to the DOWN side

If no entry Tuesday due to another UP candle, set breakout trade below that candle, and so on

Until entry into the hopefully, resuming trend

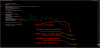

Some pictures to follow, this is the EUR/USD

Some guys on another forum reckon they are cleaning up

Sadly, they will be missing out on EUR/JPY as it had UP month in February

Stops, take profits all up to your own experience / risk tolerance / confidence

Questions / comments / criticisms / your thoughts ?????

Has anyone heard of this concept?

Look at previous Month candle e.g. Up or Down

Look at previous Week candle e.g. Up or Down

IF Month candle was DOWN and Week candle was DOWN

Don't trade Mondays, but if that candle is UP, then trade the breakout to the DOWN side

If no entry Tuesday due to another UP candle, set breakout trade below that candle, and so on

Until entry into the hopefully, resuming trend

Some pictures to follow, this is the EUR/USD

Some guys on another forum reckon they are cleaning up

Sadly, they will be missing out on EUR/JPY as it had UP month in February

Stops, take profits all up to your own experience / risk tolerance / confidence

Questions / comments / criticisms / your thoughts ?????