erebus

TFG Forum Legend

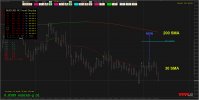

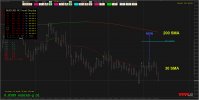

Here is what I'm thinking and looking at now, the 30 SMA on 4-Hour, using the 4-Bar Fractal as a guide because the Close price is the most important, that is, where is it?

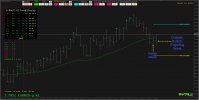

So, sticking with some guide as higher time-frame trend, best if Daily is below the 200 SMA, then looking for the early week 4-Hour move on Tuesday & Wednesday, this is where the weekly wick is made (I can point you to an excellent video on that theory) and observing the Price Action, the 4-Bar Fractal signals around the 30 SMA.

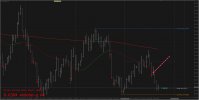

Also, market sentiment on selling NZD started on Thursday and it was obvious on Friday, even though most were saying that there wasn't any news.

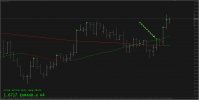

This is a basic example, but I can find others, good, bad, and ugly; your thoughts always appreciated. Have a good weekend mate.

So, sticking with some guide as higher time-frame trend, best if Daily is below the 200 SMA, then looking for the early week 4-Hour move on Tuesday & Wednesday, this is where the weekly wick is made (I can point you to an excellent video on that theory) and observing the Price Action, the 4-Bar Fractal signals around the 30 SMA.

Also, market sentiment on selling NZD started on Thursday and it was obvious on Friday, even though most were saying that there wasn't any news.

This is a basic example, but I can find others, good, bad, and ugly; your thoughts always appreciated. Have a good weekend mate.